A key cause of recent climate change is the burning of fossil fuels. To combat climate change, we need to move away from our dependence on fossil fuels.

There are only two ways to reduce our fossil fuel dependence:

- Regulation – Restrict the supply or usage of these fuels such as was done in World War II

- Carbon pollution pricing – Make the price of these fuels more expensive than the renewable alternatives

If governments put the required price on carbon pollution, they will be able to recycle the carbon revenue in ways that will help people move away from their dependence on fossil fuels.

A key reason that we burn so much fossil fuel and emit so much greenhouse gas (GHG) is because what we pay for fossil fuel does not include its true cost. Without carbon pricing, what we pay just covers the direct costs (plus some tax). But there are current and future costs that are not reflected in that “price at the pump”.

To be fair, the additional costs need to be accounted for in the cost of the fuel.

There are two additional costs that normally are not accounted for, but that we must pay indirectly:

Fossil fuel subsidies

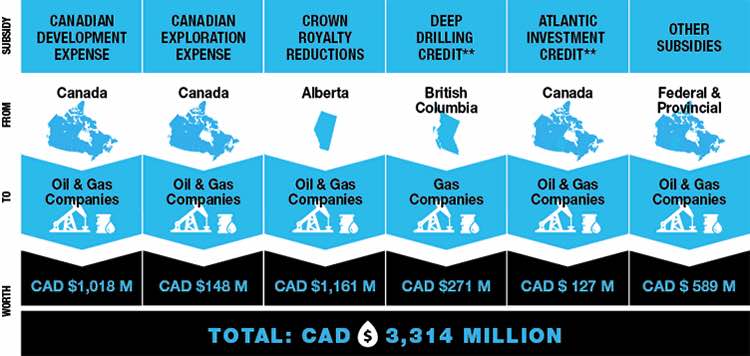

Every year fossil fuel companies get billions of dollars in subsidies. These subsidies include measures like reduced property taxes and special tax deductions for the industry, as well as direct infusions of cash from the government to companies.

The following table (1) is from a study by the International Institute for Sustainable Development (IISD) called Unpacking Canada’s Fossil Fuel Subsidies. It gives us an idea of how much we subsidize fossil fuel costs that isn’t visible at the gas station or on our heating bill. In all, Canadians pay about $3.3 billion per year in subsidies.

The exact amount changes from year to year. This chart presents a yearly average based on estimates from the period 2013-2015. During periods of higher oil prices, royalty payments will also tend to be higher.

Social cost of carbon

These costs relate to

- climate change impacts like changes in agricultural productivity, human health, and property damages (e.g. increased flooding)

- infrastructure enhancements required to adapt to climate induced changes (e.g. floodway expansion, storm drainage)

- changes in energy costs (e.g. reduced costs for heating and increased costs for air conditioning)

- environmental impacts from fossil fuel exploration, extraction, refining, and transport. (e.g. oil spills, deforestation)

Scientists and economists have tried to put a more representative cost on carbon by modelling and estimating these costs. The US Environmental Protection Agency (EPA) and other US federal agencies use the Social Cost of Carbon (SC-CO2) to estimate the climate benefits of carbon reduction policies.

Current carbon price modelling and data don’t include all of the important physical, ecological, and economic impacts of climate change. This is because of a lack of precise information on the nature of these damages and because the science incorporated into these models naturally lags behind the most recent research.

There can be a lot of debate over what a more appropriate price should be for carbon. In its Technical paper: federal carbon pricing backstop released in 2017, the Canadian federal government proposed a starting price for carbon of $10 per tonne in 2018 increasing to $50 per tonne in 2022.

In January 2015, scientists at Stanford University presented a paper in Nature indicating a present day price of $240USD per tonne is more appropriate.